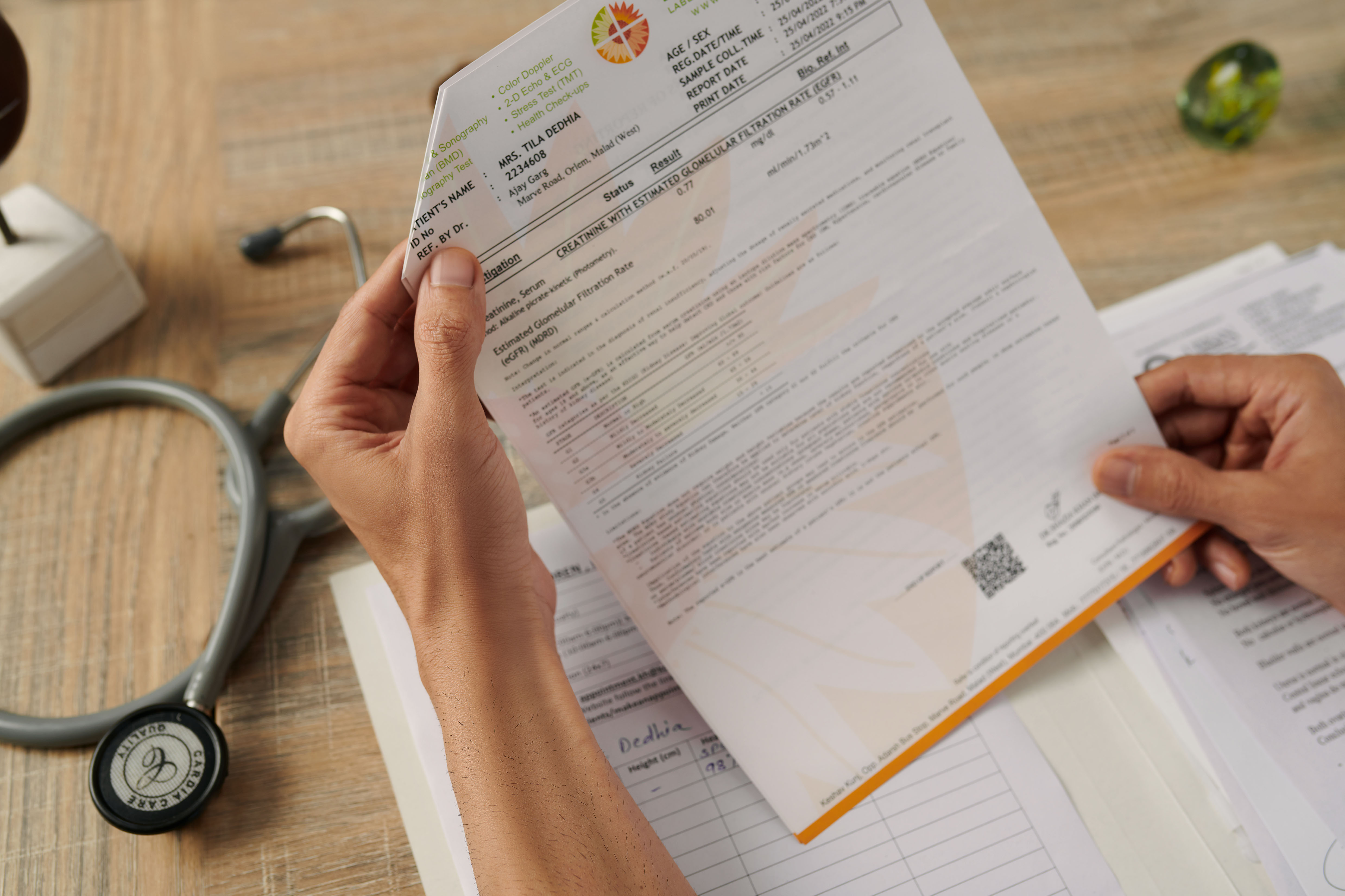

This is an optional benefit, available only with Life Option provided the policy has been underwritten on standard terms. This option has to be selected by the policyholder at the inception of the policy. All future premiums shall be waived if the Life Assured is diagnosed with any of the listed 40 Critical Illnesses or total permanent disability due to accident. An additional premium will be charged for this benefit. If Joint Life Option is chosen along with this option, then WOP is applicable only on the primary life assured.

In case of critical illness, a waiting period of 180 days will be applicable.

The critical illnesses covered under this plan -

Critical Illness

1 Cancer of specified severity

2 Open Chest CABG

3 Kidney Failure requiring regular dialysis

4 Permanent paralyses of limbs

5 Primary (Idiopathic) Pulmonary Hypertension

6 Myocardial Infarction (First Heart Attack of Specific Severity)

7 Stroke Resulting in Permanent Symptoms

8 Major organ / bone marrow transplant

9 Multiple Sclerosis with persisting symptoms

10 Surgery to Aorta

11 Apallic Syndrome

12 Benign Brain Tumour

13 Coma of specified severity

14 End Stage Liver Failure

15 End Stage Lung Failure

16 Open Heart Replacement or Repair of Heart Valves

17 Loss of Limbs

18 Blindness

19 Third degree Burns

20 Major Head Trauma

21 Loss of Independent Existence

22 Cardiomyopathy

23 Brain Surgery

24 Alzheimer’s Disease

25 Motor Neurone Disease with permanent symptoms

26 Muscular Dystrophy

27 Parkinson’s Disease

28 Deafness

29 Loss of Speech

30 Medullary Cystic Disease

31 Systemic Lupus Erythematosus

32 Aplastic Anemia

33 Poliomyelitis

34 Bacterial Meningitis

35 Encephalitis

36 Progressive Supra nuclear Palsy

37 Severe Rheumatoid Arthritis

38 Creutzfeldt – Jakob Disease

39 Fulminant Viral Hepatitis

40 Pneumonectomy

The premium rates for this option are guaranteed for five years only from the date of commencement of the policy. The company reserves the right to carry out a general review of the experience from time to time and change the premium as a result of such review on approval of the IRDAI. The company will give notice in writing about the change and the insured person will have the option not to pay an increased premium.